Tourism in Cuba in an Adverse Global Context: Emerging Markets

Tourism is one of the most dynamic, fast-changing, and powerful sectors of the global economy. Its contribution to growth in many economies across the globe is unquestionable. Nonetheless, the evolution of tourism and its consequences should be regulated to guarantee environmental sustainability, socioeconomic fairness, and appropriate distributions of the wealth it creates in the community - among many other things.

In this global context, the evidence shows that tourism has been expanding considerably during the last few years. This expansion has been driven by the sustained increase in real income and leisure time in emerging markets like China and Russia. Demand has accelerated for tourist services that respond to new, growing segments and preference profiles among consumers.

Long term, the World Tourism Organization predicts that by 2030 the number of international tourist arrivals throughout the world will be greater than 1.8 billion people. This expansion is thanks to new travelers coming from Asia and other countries like Russia.

Asia has a population of more than four billion people, which represents approximately 60% of the world population and includes the countries with the largest populations in the world, India and China. However, this is not a case of the demographic strength of the region or the fact that Asia has become a principal motor of world economic growth. Rather, the estimates are based on the growth of the middle and upper classes - one of the fastest growth rates humanity has ever seen.

For various reasons, tourism is undergoing some fundamental transformations, from its economic structure to its scope. The growth of global tensions has negatively impacted European countries that traditionally sent tourists abroad.

In this context, the Caribbean has started to lose its place in the market. The average annual growth of tourist arrivals was 1.6%, while the global average growth in tourism was twice that rate; in other words, the Caribbean is facing a continued deceleration.

These trends have been influenced by three principal factors: the surge of new destinations in various regions across the world, the frequency and intensity of extreme weather, and the lack of real innovation in the tourist products on offer. One might also add the impact of global political and economic issues from which, of course, Cuba is not exempt.

Tourism in Cuba: Between Adversity and Prohibition

The restrictions that face the Cuban tourist industry have not changed in throughout the years: the tightening of prohibitions on travel and tourism from the United States; a scarcity of material and financial resources; the dual currency system; the lack of building maintenance at hotels; the deterioration and obsolescence of infrastructure like ports and airports; and the low quality of service, among others.

Nevertheless, in 2019 the hotel capacity reached 73,000 rooms. Forty-four thousands of those rooms - spread across 88 properties - are managed by 19 foreign companies.

Figure 1. International visitors arriving in Cuba (2017-2019)

Source: Author with data from the Cuban Ministry of Tourism.

In 2019, 4.3 million international visitors traveled to Cuba, a 9.3% decrease from the year before. The decline came primarily as a result of the United States’ suspension of cruise travel to Cuba in June. The number of American tourists in Cuba dropped by 49% from 2018.

Another important change was the significant decrease, beginning in 2018, of arrivals to Cuba from its principal European sources. This confirms how political and economic factors of a global reach negatively impact tourism far away from Europe.

In Cuba, the tourism sector continues to be the main agent of dynamism in the economy and an important driving force behind production chains that ensure import substitution while helping to reduce tourism costs.

Despite the policies in Washington that undermine tourism, commerce, and foreign investment in Cuba - and the prohibition on cruise ships and the limitations on operations on American airlines there - Cuba has demonstrated yet again its ability to adapt to changing circumstances. Cuba is now looking for commercial strategies in new, emerging markets.

The Search for Emerging Markets

The Chinese market is an export opportunity for the Caribbean, and up to now it has barely been exploited. It barely represents 55% of its potential, primarily exports in fruit, tobacco, alcohol, and mineral products.

Although the Caribbean market is relatively small in relation to the broader Latin American economy, China’s commercial expansion in the Caribbean is significant. It is facilitated by the proximity to the United States geographically and its importance for American security.

In recent years China’s major companies have been positioning themselves in global markets. Cuba shows that commercial exchanges can create growing and positive effects. The Caribbean is the largest exporter to China with over $500 million in 2018, while important industrial, energy, and infrastructure projects were being carried out with the cooperation of large Chinese companies.

However, one of the weaknesses in these economic relations between the two countries is the scarcity of Chinese investment in Cuban tourism.

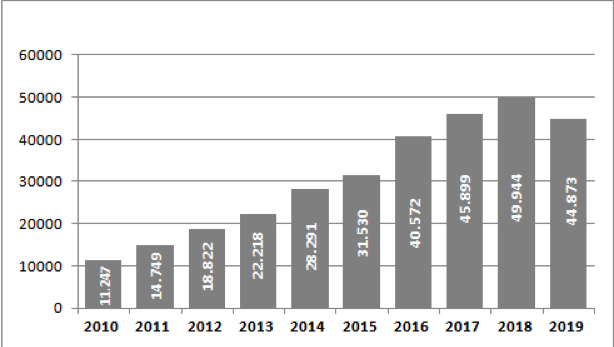

Figure 2. Chinese tourist arrivals to Cuba (2010-2019)

Source: Author with data from the Cuban Ministry of Tourism.

For Chinese tourists, Cuba is the principal vacation destination in the Caribbean, with an average annual growth rate of 23%, beginning in 2010. In 2018, almost 50,000 Chinese tourists visited the island. Despite the geographic and cultural distance, both nations have maintained political and commercial relations for sixty years and feature similar political systems.

Cuba’s attractions are important for this tourist segment. China has a little over 200 million adult consumers with salaries surpassing $50,000 a year. These tourists also enjoy multi-destination trips, so that routes through the Caribbean are successful.

During the last decade China took an important step into the middle section of the distribution of global wealth, and China now is home to over 400 million adults with at least $50,000 in net assets.

According to sector reports, during the next few years, China will register one of the greatest increases in the ultra-high net worth population segment (persons with more than $50 million in net assets). It will be home to more millionaires than any other country besides the United States.

Russia on the International Tourism Stage

Russia is a market with high economic and tourist potential. The growth in purchasing power of the population is a key factor in the growth of international travelers coming from Russia. The country has also done away with administrative obstacles relating to travel, a development which has played a fundamental role in increasing the outgoing tourist flow. It is now easier for citizens to leave the country.

The statistics show that the Russian Federation is an important source of tourists to Cuba. Exit flows to Cuba have grown continuously in the last ten years with annual growth rates varying between 10% and 20%.

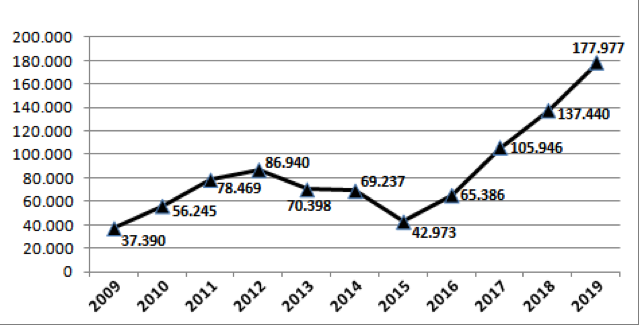

Figure 3. Tourist arrivals from Russia (2009-2019)

Source: Author with data from the Cuban Ministry of Tourism.

In the current situation, economic, political, and financial sanctions against Russia seriously damage outgoing tourism and reduce its outflow to the European Union and North America. The sanctions, in turn, will change Russian tourist preferences, leading them to choose countries outside the European Union and North America.

For Cuba, Russia represents an opportunity for a strategic partnership in the development of infrastructure projects supporting tourism. Such a partnership could also target its middle and upper segments with offerings of cultural and historical attractions, MICE (Meetings, Incentives, Conventions, and Exhibitions), eco-tourism and wellness tourism.

The growth of the Russian market for Cuba has been most significant between 2015 and 2019, featuring a 42% average annual growth rate. At the end of 2019, Russia placed fourth worldwide among Cuba’s principal tourist sources.

In Short

Cuba has confronted restrictions and regulations from the United States government, and it has faced economic uncertainty in many of its traditional tourist markets. Both of these developments would, ostensibly, affect the health of Cuba’s tourist sector. However, the positions of China and Russia in the international tourism sector represents a strengthening of new alliances and a consolidation of tourist flows in new, emerging markets.

A look to the future of Cuba’s economic relations with China and Russia shows that these two countries - like Cuba - face challenges that will require enormous efforts, understanding, and determination.

These challenges highlight the necessity of perfecting Cuba’s efforts in promoting, controlling, and carrying out the economic activity these investments generate. They require stimulating joint investments and realizing mutual gains. Finally, they require enhanced preparation and professionalism in negotiation and marketing, as well as in the selection of appropriate methods and partners for these joint ventures.

References

CEPAL (2019). “La inversión extranjera directa en América Latina y el Caribe”. Comisión Económica para América Latina. Santiago de Chile.

Euromonitor International (2015). “Distribution of Wealth. Wealth Segment Sizes and Trends”. Market Research Euromonitor International. Londres, U.K.

Expedia Media Solution (2018) “Chinese Multi-Generational Travel Trends”. Expedia Group. Available at: www.advertising.expedia.com

Jinping, Xi (2018). “La Gobernación y Administración de China”. Tomo II. Ediciones en Lenguas Extranjeras. Beijing.

MEPyD (2019). “El escenario geopolítico de las Economías de los Países del Caribe”. Unidad de Estudios de Políticas Económicas y Sociales del Caribe. Ministerio de Economía, Planificación y Desarrollo. Santo Domingo, R.D.

Perelló, José Luis (2018). “La irrupción de China en el panorama de viajes y turismo. Oportunidades para Cuba”. Instituto Internacional de Periodismo José Martí, La Habana.

Perelló, José Luis (2019). “Tourism in Cuba: Changes and Tendencies. Capacity Building Project”. Horizonte Cubano. Columbia Law School. N.Y. Available at: https://horizontecubano.law.columbia.edu/content/tourism-cuba-changes-and-tendencies

Prokopenko, Yulia (2014). “Evolución del flujo turístico ruso y su importancia económica”. Tesis Doctoral. Instituto Universitario de Investigaciones Turísticas de la Universidad de Alicante.

Prokopenko, Yulia y Mazon, Tomás (2014). “Historia del turismo en Rusia”. Gran Tour. Revista de Investigaciones Turísticas nº 9 Enero-Junio 2014 p.27-44

WTO y China Tourism Academy (2019). “Guidelines for the Success in the Chinese Outbound Tourism Market”. World Tourism Organization y China Tourism Academy. Madrid / Beijing.

WTO y ETC (2018). “European Union Tourism Trends”. World Tourism Organization and the European Travel Commission. Madrid, España.

WTO y GTERC (2019). “Asia Tourism Trends”. Edition 2019. World Tourism Organization y Global Tourism Economy Research Centre (GTERC). Madrid / Macao.

WTO (2020). “World Tourism Barometer”. Volume 18, Issue 1. January 2020. World Tourism Organization (UNWTO). Madrid.

José Luis Perelló Cabrera is a full professor of the Tourism Faculty at the University of Havana, where he is a member of the faculty on Caribbean Studies. Professor Perelló received his master’s degree in tourism and doctorate in economic sciences from the University of Havana, as well as a Master’s in Business Administration (concentration on tourism) from the ESADE in Barcelona, Spain. He has been a visiting professor at universities in the United States and Central and South America. Professor Perelló has published various books and articles in relevant journals, both nationally and internationally and in the media of various countries. He concentrates his research on international migration and tourism development.