Inflation in Cuba, and the Economy’s Potential Recovery (Part II)

Omar Everleny Pérez Villanueva

The biotechnology and pharmaceutical sectors in Cuba could drive growth and be a source of foreign currency, helping to rescue the economy from the current balance of payments crisis.

The original Spanish version of this article was posted on February 3, 2022

The government economists in Cuba estimate that the Cuban economy grew by 2% in 2021. This represents a third of the average growth estimated for the region, according to the Economic Commission for Latin America and the Caribbean. This low growth does little to repair the 10.9% economic contraction in 2020. These past several years of crisis have aggravated historical structural distortions in the economy, creating new vulnerabilities.

Cuba’s GDP structure reflects the government’s tendency to reduce the relative weight of sectors such as agriculture, manufacturing, construction and transportation in an economy that needs a much greater contribution from these sectors given its level of economic development. In 2020, these sectors represented 72% of Cuba’s GDP.

Gross capital formation has remained very low. It fell to 9.9% of GDP, according to ONEI (the National Statistics Office of Cuba) data for 2020, well below the Latin American average (17.2%) and far below such Asian and Latin American countries as China, Vietnam, South Korea and Costa Rica that have undertaken an accelerated path to development, starting from a similar socioeconomic system.

In Cuba, investments are highly concentrated in services, hotels and public administration, while other sectors are neglected. The most striking cases are the manufacturing and agricultural sectors. Their contributions to GDP have declined, and their performance has decreased over the past three years. This can be explained by, among other factors, low levels of investment in these sectors.

Agriculture and Tourism

Agriculture accounts for 20% of total employment in Cuba; its direct contribution to GDP was 2.8% in 2020, a reflection of low productivity. Many of the state enterprises with numbers in the red are concentrated in the agricultural economic sector. [i]

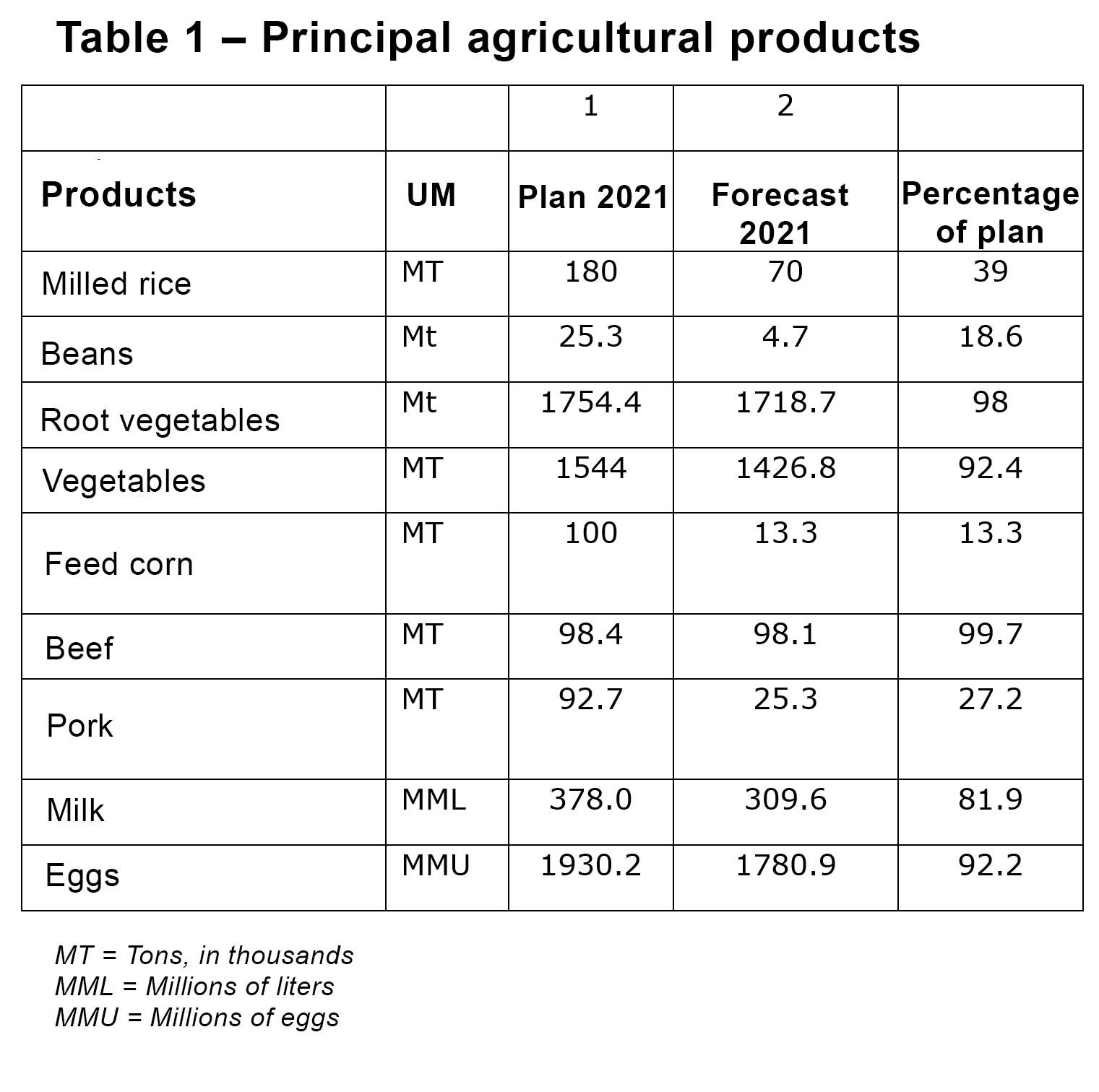

Improvements in the agricultural sector remain insufficient. Marketing mechanisms have been made more flexible, but without the implementation of real incentives or market signals for the agricultural sector. There is no guarantee that changing the mechanisms for contracting and price setting from the national level to the municipal level (as has been done recently) will ensure the success of administrative mechanisms that did not work at the national level[ii]. The 63 measures that the Cuban government claims to have taken in the agricultural sector have not achieved the goals the government itself established (see Table 1)

Source: Ministry of Economy and Planning. Main aspects of the 2022 national economic plan, December 2021.

Sugar production yielded less than 700,000 tons in 2021, one of the worst harvests in the last century. Multiple issues contributed to this historic low, including mounting decapitalization and soil quality problems. Yet other factors could be addressed in the short term, for instance, promoting sufficient investment, transforming administrative procedures to combat bottlenecks and drastically changing the incentive system for producers, state-level managers and workers.

Tourism began to recover in 2021, although much more modestly than a full market rebound and with continued uncertainty about the evolution of the Covid pandemic. The figures are far from what was achieved in prior years. In 2021, there were likely fewer than 324,000 visitors, only 30% of the number of visitors to Cuba in 2020, a period during which no tourists were admitted for almost nine months.

Only about 6,000 Americans traveled to Cuba in 2021, one of the lowest figures in the past twenty years, and 10% of the 2020 number. Arrivals of Cubans residing abroad totaled about 47,000 by December 23, 2021, 33% of the total who visited the previous year. Some improvement in the travel sector has come from an increase in domestic tourism (paid in CUP, or Cuban pesos), which is primarily concentrated in beach and resort areas such as Varadero, the northern keys of Villa Clara and Ciego de Ávila.

Earnings (in foreign currency) from tourism services in 2021 are estimated at approximately $675 million dollars. In the telecommunications sector, exports are expected to reach $786 million in 2021. In total, services exported amounted to $6.767 billion in 2021; exported goods that year amounted to $1.875 billion.[iii]

Foreign Trade

The performance of foreign trade continues to be marked by the limits imposed by US sanctions. This year there has been additional deterioration of foreign trade as a result of global inflation, increasing the cost of imports, especially the cost of imported food. The balance of payments crisis has left the Cuban government with less access to financing and foreign currency to sustain imports and support exports.

This imbalance of goods typifies the performance of Cuban foreign trade since 1959, although the real effects have been more acute since 1991 and continue until today. Despite the fact that the exportation of more goods has long been among the Cuban government’s official priorities, exports have not increased. The most dramatic example is Cuba’s quintessential agricultural product, sugar.

Problems of competitiveness are also apparent in Cuba’s high dependence on imported food, medicine and a wide variety of intermediate goods, which together comprise more than 60% of total imports. There has been little progress in the efficient substitution of most imports, a frequently declared priority of the Cuban government.

One of the characteristics of the Cuban economy is the predominance of services in the country’s foreign trade; the deficits presented in the trade balance of goods are converted to surpluses when services are included. But, in 2021, services did not compensate for the trade imbalance, thus worsening the balance of payments crisis.

Cuba’s external financial situation has once again led officials to try to prioritize decisions that encourage companies and institutions to obtain foreign currency. Despite the devaluation of the exchange rate and the official appeal for import substitution and export generation, high levels of centralization remain one of the most important obstacles to fulfilling these objectives.

The rules have not changed sufficiently for state enterprises, despite numerous measures the government claims to have put in place. This is an example of how the decisions associated with monetary reforms—in this case, the devaluation of the exchange rate—are not enough to transform the environment in which enterprises operate, nor to improve their competitiveness or the results of the economy’s external sector. Monetary reform requires complementary policies and changes for its benefits to materialize.

The Economy Bottoms Out and Recovers Asymmetrically

Quarterly GDP data reveals that the Cuban economy already bottomed out and began to recover in the second quarter of 2021. After declining for seven consecutive quarters (since the third quarter of 2019), GDP returned to positive annual rates in the second and third quarters of 2021. (Data for the fourth quarter are not yet published.)

In the second quarter of 2021, Cuban GDP grew by 7.9% compared to the same period the previous year. This was driven by annual growth in education (106%); hotels and restaurants (42.9%); public health and social assistance (20.5%); and transportation, storage and communications (12.5%). In the third quarter of 2021, GDP grew 2.4%, driven by growth in the transportation, storage and communications sectors (23.4%), as well as public health and social assistance (32.5%).

Although this constitutes an average economic recovery, notable asymmetries remain. While the previously identified sectors (all concentrated in services) have grown at double-digit rates in recent quarters, other sectors continued to contract at a similar pace. For example, in the third quarter of 2021, the inter-annual rates of sectors such as agriculture, fishing and manufacturing were, respectively, -11.6%, -12.4% and -10.2%. Commerce has not bottomed out at -11.3%, nor has culture and sports at -13.3%. Hotels and restaurants, which had grown significantly in the second quarter of 2021, plummeted 23.8% in the third quarter of that year.

By 2022, the Ministry of Economy and Planning expects a 4% increase in GDP, which appears to be possible. The gradual recovery of tourism, as a result of increased immunizations (thanks to vaccines developed in Cuba), will make it possible to avoid new extreme restrictions on domestic mobility and could help sustain the reopening of airports and borders, although the flow of visitors will be affected by the evolution of coronavirus variants and other developments in the pandemic.

Although it is difficult to predict the dollar amounts, some economic relief can be expected as income from tourism begins to flow to the state and private sector and more aid and remittances arrive from Cubans abroad.

The expansion of small- and medium-sized enterprises (SMEs), non-agricultural cooperatives and self-employed workers in new activities will help reactivate employment and family income, although nuanced by complex macroeconomic issues that will limit their opportunities and profitability. SMEs will begin to drive innovation, add flexibility to the business sector and contribute to the competitiveness of large domestic and foreign enterprises.

The opening of the private sector facilitates the necessary restructuring of the state sector and the closure or downsizing of state enterprises that have shown losses after the exchange rate devaluation. This decision constitutes the most important immediate complement to enhance the efficiency gains that can be derived from the Cuban monetary reform.

Exporting vaccines produced in Cuba could be an important element in the country’s economic improvement going forward.

In terms of export value, medicines peaked in 2013, with reported revenues of more than $600 million; this is largely due to agreements with Venezuela that included the provision of medical services. However, like total exports, medicine exports have dropped, followed by stagnation, since 2013.

In 2019, before the pandemic, the reported export value of medicines was $267 million, or 55% less than the maximum reached in 2013. This value is close to sugar and tobacco exports and represented 13% of the Cuba’s total exported goods, slightly more than 2% of the total exported goods and services.

The biotechnological and pharmaceutical sectors could drive growth and be a source of foreign currency to help rescue the economy from the current balance of payments crisis. In addition, a loan from the Central American Bank for Economic Integration (CABEI)[[iv] provides important financial assistance and an international vote of confidence in the potential of Cuban vaccines.

However, a 4% economic growth rate in 2022 and improvements in some indicators will not be enough to reverse the shortage of raw materials and consumer goods, and will not completely protect enterprises and the population from inflation. There are, however, some potential signs of relief.

[i] http://www.cubadebate.cu/noticias/2021/10/27/tarea-ordenamiento-la-inflacion-minorista-ha-sido-la-principal-desviacion-afirma-marino-murillo/

[ii] https://horizontecubano.law.columbia.edu/news/economia-de-mercado-o-economia-de-municipio-en-la-agricultura

[iii] Authors’ elaboration based on the report of the Ministry of Economy and Planning. Main aspects of the 2022 national economic plan. December 2021.

[iv] https://www.bcie.org/novedades/noticias/articulo/bcie-aprueba-primera-operacion-a-cuba-por-eur467-millones-en-apoyo-al-combate-de-la-covid-19.