Cuba: Dollar Crunch, Dollarization and Devaluation

Cuba faces an acute balance of payments crisis aggravated by the COVID 19 pandemic reflected in severe shortages of food, medicine and essential goods. So far measures taken to deal with the crisis are largely fiscal – a tightening of government outlays and services to preserve dollars for essential imports, a scheme to capture proceeds from remittances and efforts to sell government medical services abroad. These are short-term in nature and do not accomplish the necessary structural reforms and liberalization of the economy.

By Luis R. Luis

The Dollar Crunch

There is a paucity of timely statistics required to precisely gauge the balance of payments. Detailed figures for the current account have not been published for many years, much less for capital account transactions. Monetary data is outdated and rudimentary as are even basic data on prices, wages and the activity of private firms. Up-to-date statistics on foreign trade can only be obtained from reporting of foreign countries’ exports to Cuba as well as imports from the island.

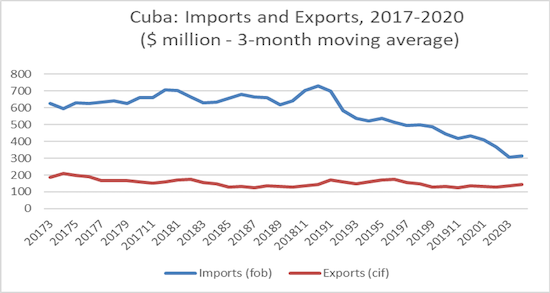

Figure 1 shows monthly 3-month averages for exports and imports as reported in the IMF’s Direction of Trade from early 2017 to April 2020 (IMF 2020). The reduction in monthly imports is dramatic from $650 million per month in 2017-2018 to $315 million in the first four months of 2020, and this does not yet take into account the impact of the pandemic. The halving of imports denotes the sharp dollar crunch facing the economy from its inability to raise sufficient revenues from overall exports as well as its minimal access to foreign credit. Merchandise exports in 2019 are a bit less than half the 2012 level.[1] However, Figure 1 shows that goods exports are not an immediate part of the dollar crunch as they are only slightly lower in the first third of 2020 as against 2017. The major problem is a sharp fall in services export receipts mainly from Venezuela (Luis 2020). This follows the failure of Venezuela to pay in dollars for medical, security and other services which Cuba invoices at a very high price. Venezuela accounted for close to 90% of billed exports of Cuban professional services in 2018. Weakness in tourism has been also a factor as a result of US restrictions and a feeble European market while the pandemic shut-down the island to foreign visitors. It is unlikely that remittance inflows weakened before the pandemic struck in April. On a positive note, data from Mexico suggest remittance flows from the U.S. are surprisingly resilient in the face of U.S. economic contraction in the second quarter of 2020.

Will the dollar crunch lead to a calamitous shortage of essential imported foodstuffs especially grains and meats to satisfy the minimum needs of the population? Foodstuffs imports were $1.9 billion in 2018, ONEI (2019). As a rough estimate and assuming there are no massive crop failures in Cuba, the country in 2020 will need $1.8 billion to complement domestic food production plus $150 million for imported farm inputs. Remember there are few tourists in Cuba to feed from imported sources and local farms. Needed monthly imports of food are $160 million or about one-half of average imports in January to April 2020. Current account potential receipts in 2020 from nickel, tobacco and miscellaneous manufactured exports plus remittances are $4.7 billion or $390 per month. This suggests basic foodstuff imports may be acquired though at the cost of severe shortages of manufactured goods, raw material and even high priority medical and pharmaceutical products. Variations in monthly cash flow from exports and remittances can pose severe problems which would have to be met from declining international reserves. Cuban assets in international banks declined by $430 million in the first quarter of 2020 to $2.52 billion and are down $1.26 billion since the end of 2018 (BIS 2020). These are sobering figures.

The dollar crunch is reflected in the foreign exchange market. Cuba has in place restrictions on currency transactions and maintains fixed official exchange rates for its two currencies the CUP or Cuban peso and the CUC or convertible peso with special treatment for specific industries and even for the port of Mariel development zone. Accounting rules for firms require use of a $1 = CUP 1 for transactions involving dollars. The nominal value of the CUC is set at CUP 24. However, for dollar transaction the CUC is set at CUC 1 = $1 while the currency trades in the black market at lower values. After the elimination of a 10% tax on dollar transactions in July 2020 the CUC traded close to its nominal value. As the dollar crunch intensified in the Summer of 2020, and the government tightened required use of the U.S. currency for purchases in state stores via special dollar accounts, the dollar soared in the black market with bids in mid-September within a range of CUC 1.5 to CUC 1.8.

Dollarization and the Exchange Rate

Dollarization is a general term denoting the use of the U.S. dollar or another hard currency such as the euro for transactions and as a store of value in a given economy. There may be complete dollarization such as in Panama, Ecuador and El Salvador where the dollar is legal tender and the currency is the one used for domestic transactions. In many other countries in Latin America and elsewhere partial dollarization takes place as the population increases dollar holdings as protection against inflation, devaluation and financial instability. During the 1990’s Cuba had an episode of dollarization as the currency was allowed to be used for a variety of transactions during the special period. In recent years Cuba is experiencing dollarization as individuals hold dollar assets obtained from remittances or tourism. In what follows I provide an explanation of dollarization and the exchange rate on the basis of a rational expectations model described in the Appendix.

Dollar holdings and the exchange rate

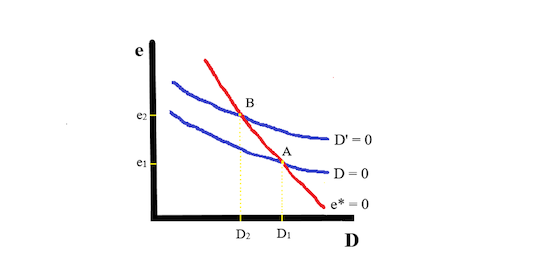

Figure 2 shows the dynamics of dollarization as related to the exchange rate and expectations of change in the exchange rate. The graph shows dollar holdings of individuals and firms in the D horizontal axis and the exchange rate in domestic currency for dollars (CUCs per dollar for example) in the e vertical axis. The blue curve D = 0 shows 0 net dollar receipts from trade and transfers such as remittances for values of the exchange rate when there are no expectations of change in that variable.[2] It means the current account is balanced. The red curve e* = 0 shows the points at which the expected exchange rate change is 0 given levels of the actual rate and dollar holdings by the population. The shape of this curve depends on decisions by individuals and firms as to the proportions of dollars and domestic currencies held. Point A in the graph is an equilibrium where the public is holding D1 dollars at exchange rate e1. Dollarization measured in dollars is D1 while measured in domestic currency it is e1 x D1. Official exchange rates in Cuba are below e1 meaning they are overvalued versus the unobserved equilibrium. It also means the country has a deficit in the current account.[3]

CUPs and CUCs

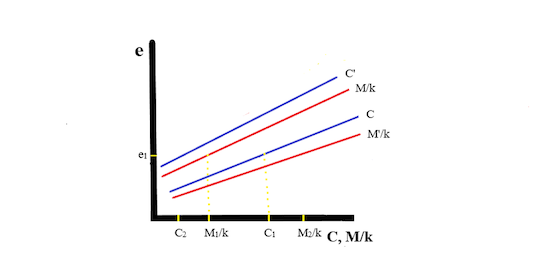

What happens to the population’s holdings of local currency? In our model we have two local currencies as in Cuba. One is M (the CUP), the other C (the CUC). These two are related by an official internal rate of exchange k. The central bank maintains k stable by offering to buy and sell local currencies at this rate as necessary. This allows the population to modify their holdings of M and C. Schedules C and M/k in Figure 3 show holdings of the two local currencies at different exchange rates given expectations of 0 change in the exchange rate. At the equilibrium exchange rate of e1 reached in Figure 1 individuals and firms hold M1/k + C1 in local currency. Government regulation and controls can make the C currency less attractive, for example by restricting its use in stores that sell popular consumer goods. This will cause the curve C to shift upwards to C’, and the public will lower its holdings of C to C2. This is offset by the central bank exchanging C by M and the public will hold the same total amount of local currency as before (M2/k + C2). This shows in essence the monetary aspect of currency unification, and it is not a difficult task for the central bank although a big challenge for managers and accountants. A far more daunting problem is how to deal with the overvalued exchange rates.

The Devaluation Conundrum

A wrong-headed approach to the balance of payments crisis is the forced capture of dollars from professional services abroad and remittances due to private individuals. State-directed sales of medical services is injurious to human and labor rights and much less effective than giving doctors freedom to choose their patients and send funds back to the island. Likewise, restricting dollar transactions to high-margin state stores is self-defeating, and will tend to slow the flow of money from abroad. These measures do not address effectively the serious imbalances in the Cuban economy.

The government has made clear that it wants to unify the two currencies and implement a devaluation of the resulting single currency, presumably the CUP. No official details have emerged regarding the future exchange regime, regulations and needed liberalization measures regarding prices, private firms and the legal system.

The analysis above shows that an adverse external shock hits devaluation expectations and leads to more currency overvaluation. This is the message of the black market. The differential among official exchange rates and with the black market is astounding. It is 2400% within official rates and 4300% with the black market as of mid-September. Well-conceived policies may reduce this last differential by 4/5 or more and allow a more manageable situation. This requires wide liberalization of the economy simultaneously with unification and devaluation. The model used here implies that production is sensitive to the real exchange rate and able to improve the trade balance. This is achievable in a more flexible operating environment for firms and the labor force.

Cuba cannot count with official external finance to bolster exchange rate stability and support essential imports without deep reforms and economic and institutional liberalization. Even more importantly, credible reforms can greatly assist in improving expectations of economic behavior needed for financial stabilization.

Conclusion

Cuba is facing an acute dollar shortage as a result of longstanding weakness in exports, collapsing professional services revenues accrued from Venezuela and the shutdown of tourism by the COVID 19 pandemic. This results in a contraction of essential imports. It also leads to rising devaluation expectations reflected in the dollar black market. Dollarization is being tightly controlled even as fewer dollars are held by the population. Exchange rates of the two official currencies are overvalued by a factor as large as 40. The monetary aspects of currency unification are straight-forward, but the large devaluation needed to bring balance to the current account is a formidable challenge requiring broad liberalization of the economy so that currency expectations stabilize and production can respond to a lower real exchange rate.

Appendix

CURRENCY SUBSTITUTION MODEL

The graphs in the text are derived from a simple rational expectations model of currency substitution. The model follows a long line from Calvo and Rodriguez (1977), Dornbusch and Fischer (1980) and more recently Kumah and Mwase (2015).

The model used here specifies that individuals and firms hold assets in three different currencies, M, C, domestic currencies and D, U.S. dollars. Equations (1) to (3) are portfolio demand functions by individuals and firms for each of the three currencies. The arguments of the equations are i, r and id, interest rates for the three currencies and expectations about the change of the exchange rate, e* (= ∆e). W is the overall wealth of the population, equal to the sum of the three currencies. Equation (4) is the current account balance representing the flow of dollars, D* (= ∆D) , while P is the price level, R remittances. In this last equation the current account balance is a function of the real exchange rate, remittances and income from dollar assets. E is the expectations operator. Variables are expressed per unit of time.

M = m(i, r, id, E(e*))W (1)

C = c(r, i, id, E(e*))W (2)

eD = f (id, i, r, E(e*)) W (3)

D* = g(e/P) + idD + R (4)

The dynamics of this model can be obtained by differentiating equations (1) – (3) and solving for the expected change in the exchange rate, E(e*). The solution is a function:

E(e*) = h(eD/W, M/W, C/W) (5) Where h1 > 0, h2, h3 < 0

Equation (5) means that the expected change in the exchange rate is a function h of the holdings of dollars and the two domestic currencies. Equations (3) and (5) drive dynamics of the system and determine the slope of the curves in Figure 2 and Figure 3 when the current account is in balance and E(e*) = 0. The slopes are:

de/dD = - e/D, de/dD = - id/ge/p for Figure 2 and de/dm = - h2/h1D > 0, de/dc = -h3/h1D > 0 for Figure 3.

References

Bank for International Settlements, 2020, International Banking, locational statistics, bis.org.

Calvo, G.A. and C.A. Rodriguez, 1977, “A Model of Exchange Rate Determination under Currency Substitution and Rational Expectations.” Journal of Political Economy, vol. 85.

Dornbusch, R. and S. Fischer, 1980, “Exchange Rates and the Current Account.” American Economic Review, vol. 70.

Hernandez-Cata, E., 2019, “The Misery of Cuban Merchandise Exports and the Sustainability of the Balance of Payments.” ascecuba.org/blog.

International Monetary Fund, 2020, Direction of Trade, IMF.org.

Luis, L., 2020, “Cuba’s Uncertain Revenues from Medical Exports.” ascecuba.org/blog.

Mendez, R., R. Pineda and R. Romeu, 2020, “Cuba’s Macroeconomic Vulnerabilities to Venezuelan Shocks.” Paper presented at the Annual Meeting of the American Economic Association, January.

Kumah, F. and N. Mwase, 2015, “Revisiting the Concept of Dollarization: The Global Financial Crisis and Dollarization in Low-Income Countries,” IMF Working Paper, WP/15/12.

Oficina Nacional de Estadística e Información, 2019, Sector Externo

[1] Hernández-Catá (2019) presents an analysis of the long-term travails of Cuba’s merchandise exports.

[2] In terms of local currency, the economy could be less or more dollarized depending on the portfolio preferences of the population and monetary policy. In Figure 2, the economy is slightly more dollarized valued in local currency at B than at A.

[3] In terms of local currency, the economy could be less or more dollarized depending on the portfolio preferences of the population and monetary policy. In Figure 2, the economy is slightly more dollarized valued in local currency at B than at A.

Luis R. Luis is an international economist in Massachusetts specializing in international finance and investments. He is cofounder of International Research and Strategy, a firm centered on emerging markets finance. Previously he was Managing Director at Scudder Investments in Boston directing international research and helping to manage international fixed income and equity portfolios. He was Director, Latin America Department, at the Institute of International Finance in Washington. Luis also served as head of international economics at Midland Bank in London and Crocker Bank in San Francisco and was Chief Economist at the OAS in Washington. He was in the economics faculty at the US Naval Academy in Annapolis and American University and held a Fulbright visiting professorship at University of Trujillo in Peru. He has lectured on international economics at universities in several South American and European countries. An author of articles on international finance and on the Cuban economy and a contributor to several books on emerging markets and portfolio management, Luis holds a PhD degree in economics from the University of Notre Dame.