Physical capital and infrastructure are languishing. Should Cuba be concerned?

Cuba is destined for a radical transformation to address two processes that are approaching: the accelerated aging of its population, and the energy transition. The current model does not appear to offer a framework within which the vast resources needed can be mobilized.

The fact that economic growth in Cuba has been very low is evidenced not only by the scattered data available but also by visible confirmation. The high-end urban hotels built in the last five years do not change the overall economic picture but rather bring into question the allocation of resources and the institutional and political logic underlying them.

The renowned study on patterns of economic growth published by the World Bank in 2008 pointed out that the accumulation of physical capital is an essential ingredient for long-term progress. It also offered simple rules for identifying needs.

According to empirical evidence collected in 13 different economies from all continents, the resources invested should be, on average, equivalent to more than 25% of the Gross Domestic Product (“GDP”) per year. Of these, approximately 7% should be allocated to physical infrastructure, such as roads, railways, ports, and airports, and in the 21st century, to communication and data exchange networks.

The analytical framework of supply-side growth models provides tools to analyze the constraints that the Cuban economy is facing in the immediate and long term. A generalization of these models identifies four main factors to explain economic growth: physical capital, labor, human capital, and technology.[1]

All factors combine in the growth process, so it is more desirable to speak of complementarity than of the substitution of one factor for another. Physical capital is necessary to adequately use the rest of the productive factors. This is evident in the deployment of the labor force and human capital.

Deploying human talent requires hardware that, in the 21st century, consists of specialized machines and systems, together with the infrastructures of the digital age. A certain correspondence between human and physical capital is required for the former to be truly productive. At the end of the 20th century, a renowned economist acknowledged that “it takes a modern computer to train a good programmer.”

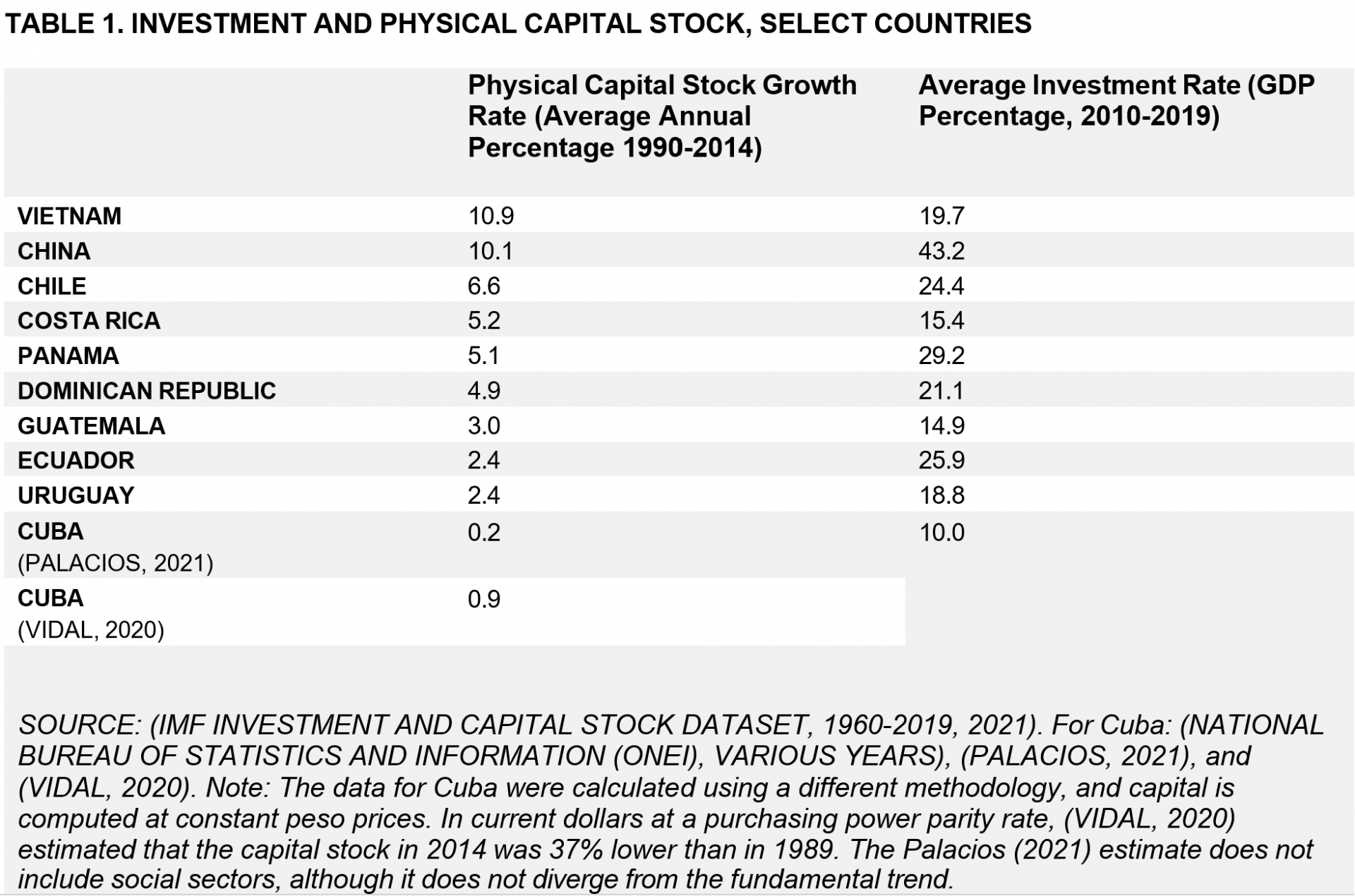

Various authors have measured physical capital stock in Cuba using different methodologies, periods, reference currency, and primary data, which are always scarce and incomplete. The results reflected consensus in some aspects and not others. In general, everyone agrees that between the 1970s and 1980s, investment volumes were higher and this led to a sustained increase in physical capital stock.

With the deep economic crisis of the 1990s, this trend was reversed, revealing what were by international standards, marked contractions. Major differences between the author researchers surfaced at this stage. Most assumed that capital stock began to grow slightly in the early 2000s. However, the speed of that recovery diverges markedly by researcher. In some cases, the authors estimated that, in 2014, the physical capital stock would have recovered to 1989-1990 levels.

Other authors maintain that this recovery would never have occurred. Nevertheless, considering that the number of people employed increased over the same period, the conclusion is that the physical capital per employee will remain below 1980s levels - well into the 21st century. The availability of physical capital per worker is a key driver of productivity gains, and for the diffusion of technological progress.

What these figures indicate can be visually confirmed when traveling around the island. An enormous delay in the accumulation of physical capital - which in some sectors is already a present threat. This is evidenced by the low reliability of the electricity system, the depletion of residential stock, or the state of transportation routes. By the end of 2022, calculations based on official data from the Cuban statistics office and routine press information indicated that almost 60%[2] of the nominal installed capacity for electricity generation was out of service due to lack of maintenance and operational failures (Piñón & Torres, 2023). This situation has not improved during 2023.

The government commonly refers to unexpected plant outages due to breakdowns as the causes of frequent service interruptions. This causes enormous instability in the electricity supply, with systematic blackouts that reduce citizens' quality of life and affect the production of goods and services.

With respect to housing—according to estimates by the Cuban authorities themselves— almost 40% of the buildings are in poor to fair condition, with an estimated deficit of close to 900,000 units (Cubadebate, 2021). Additionally, many dwellings are built with inadequate materials to withstand common natural disasters on the island, such as tropical cyclones.

Moreover, the data conceals significant disparities at the sectoral level since it is clear that some segments managed to expand their productive capacities (in some cases significantly). In contrast, others have seen their capital stock reduced and with it, the ability to increase production volumes.

These two extremes are seen in the trajectories of two segments: international tourism and sugarcane agribusiness. The number of hotel rooms multiplied 4.1 times between 1990-2021, at a rate of 4.6% per year, 23 times the rate of increase of the country’s physical capital stock. Conversely, sugar mills fell from 156 in 1990 to 44 in 2021. Of these, less than half of the sugar mills participated in the 2023 sugar harvest.

One of the characteristics of the "updating" process (the timid reform launched by Raul Castro) is that it modifies the reporting on the cyclical nature of the State’s investment, and the reporting now includes a sectoral investment profile. Since 2015, government investments have grown at a rate that far exceeds the increase in the GDP, and this trajectory has barely changed since the economic crisis that began in 2019. These investments are concentrated in the hotel complex associated with international tourism, mainly urban, and in the country's capital, Havana, and to a lesser extent, Varadero and the Mariel Special Zone in Artemisa.

What has failed?

The official government discourse offers the following line of arguments. The State wants to invest to increase productive capacities and build more housing, but it lacks sufficient resources. Why are there no resources? Essentially due to the "blockade" (i.e., the embargo) and an adverse international environment.

Nothing is said about the use of resources nor about the returns obtained from past investments, the vast majority of which generated debts that now remain unpaid. Very little is said about the possibility of citizens themselves investing, aiming to obtain a return on that investment within a framework that offers guarantees against confiscation and the arbitrariness of the State.

It is not strange that investment is so low in a country that rejected the profit motive as part of its economic system. Without a profit motive, there are no real incentives to accumulate economic assets and use them properly. Supposedly, central planning and moral conscience were to have emerged as effective incentives for the "new man." We now know that this has not worked.

- In practical terms, the legal and regulatory framework does not provide guarantees for potential investors, domestic or foreign.

- Instead, the accumulation of wealth is criticized as an exaltation of individualism and the inequalities of capitalism.

- In this environment, potential investors cannot establish reasonable expectations regarding the growth and profitability of their resources, so it is not surprising that the population has not produced sufficient savings for investment.

- Then, the economic machinery, responding to arbitrary decision-making and distorted prices, "guarantees" that the allocation of capital is inefficient and returns unattractive, resulting in fewer resources for future investment.

- If we envision this perverse cycle operating for six decades, the trajectory of the decapitalization sustained by the Cuban economy can be appreciated in all its magnitude.

Even without addressing the changes necessary in the political system, Cuban authorities can try to understand what happened in China and Vietnam. Instead of preserving a "downward" model of equality—that is, sharing what little is produced—they recognized that, although relative inequality may increase with a market system, the vast majority of people can achieve substantial improvements in their living standards, if the authorities were to allow profit-making and guarantee valid private capital investments.

It is no coincidence that both China and Vietnam have enjoyed some of the highest investment rates worldwide for more than three decades. And it did not take long for economic improvements to manifest themselves in social improvements, including labor training and better use of human capital.

Today's Cuba is not a total stranger to market mechanisms. Despite the continued existence of far too many restrictions and economic policy management permeated with uncertainty, once a more flexible legal framework for private businesses was adopted in 2010, the number of self-employed workers increased exponentially with little financing from the banking system. In other words, resources "appear" not through an act of magic, but by responding to incentives.

We have experienced a similar process since 2021, when the government formally authorized national privately-owned companies. Other researchers point out that changes in housing regulations since 2012 favored investment in the residential real estate market, complementing the dynamic private productive activity.

For example, experts calculated the flows received by the residential sector between 2012 and 2017 at 7 billion convertible pesos (equivalent to dollars at that time) (García-Pleyán, 2019). Suddenly, it made sense to invest in housing because it could be valued and monetized in a relatively open market with minimal collateral.

Following the collapse of several buildings in Old Havana and its cost in human lives, a renowned Cuban professional took to social media and highlighted the contradictions of an "urban reform" that benefited low-income sectors in the short term, but deprived property owners of adequate incentives for maintaining the housing fund (Tablada, 2023).

Stripping housing of its commodity character may generate sympathies, but at enormous long-term costs. Currently, the housing shortage has only worsened, and resources allocated to maintenance are few. The weight of these problems falls on the most vulnerable segments of the population, those whose options are very limited in a stagnant economy.

The challenges are huge. It is difficult to imagine how the current paradigm can generate the economic processes and accumulation of physical capital that Cuba so urgently needs. If the last three decades were challenging, the future will be no less so. The island is destined for a radical transformation to address two processes that are fast approaching: the accelerated aging of its population and the energy transition. The current model does not seem to offer a framework within which the immense resources needed can be mobilized.

References

Cubadebate. (February 7, 2021). Cuba analiza logros y deficiencias de su programa nacional de vivienda (Cuba analyzes achievements and shortcomings of its national housing program) Cubadebate. Source: http://www.cubadebate.cu/noticias/2021/02/07/cuba-analiza-logros-y-deficiencias-de-su- programa-nacional-de-vivienda/

García-Pleyán, C. (October 28, 2019). ¿Languidece el mercado inmobiliario en La Habana? (Is the real estate market languishing in Havana?) OnCuba. Source: https://oncubanews.com/opinion/columnas/la-habana-de-500/languidece-el-mercado-inmobiliario-en-la-habana/

IMF Investment and Capital Stock (2021). Dataset, 1960-2019. Washington DC: IMF. Source: https://infrastructuregovern.imf.org/content/dam/PIMA/Knowledge-Hub/dataset/lnvestmentandCapitalStockDatabaseUserManual andFAQ May2021.pdf

Oficina Nacional de Estadísticas e lnformación (National Office of Statistics and Information) (ONEI). (various years). Anuario Estadístico de Cuba. La Habana: ONEI. Palacios, J. C. (2021). Internal and external constraints of the Cuban Productive Sector. Growth and Change, 52, 492- 517.

Piñon, J., & Torres, R. (17 de May de 2023). The National Electric Grid and the Future of the Cuban Economy. Horizonte Cubano. Source: https://horizontecubano.law.columbia.edu/news/national-electric-grid-and-future-cuban-economy

Tablada, A. (October 5, 2023). No debieron morir (They shouldn’t have died). La Joven Cuba Source: https://jovencuba.com/no-debieronmorir/?fbclid=lwAR2nO8D0kXYBzXbPCFFaUYQYZncqPbom9KqU16uM5KP1R9fCG4 n-b8yNHA

Vidal, P. (2020). Where the Cuban economy stands in Latin America. Cuban Studies, 49, 97-118.

[1] The definition of technology in this literature equates it to knowledge, and refers to the recipe or program necessary to combine the rest of the productive factors. It is usually used as a synonym for equipment or machinery, but it covers a broader notion that also includes institutions. The norms and rules that govern the behavior of agents and determine their decisions during the production process.

[2] The low availability is also the result of fuel shortages.