Legal Structures for the Non-state Sector According to the Type and Scale of the Activity

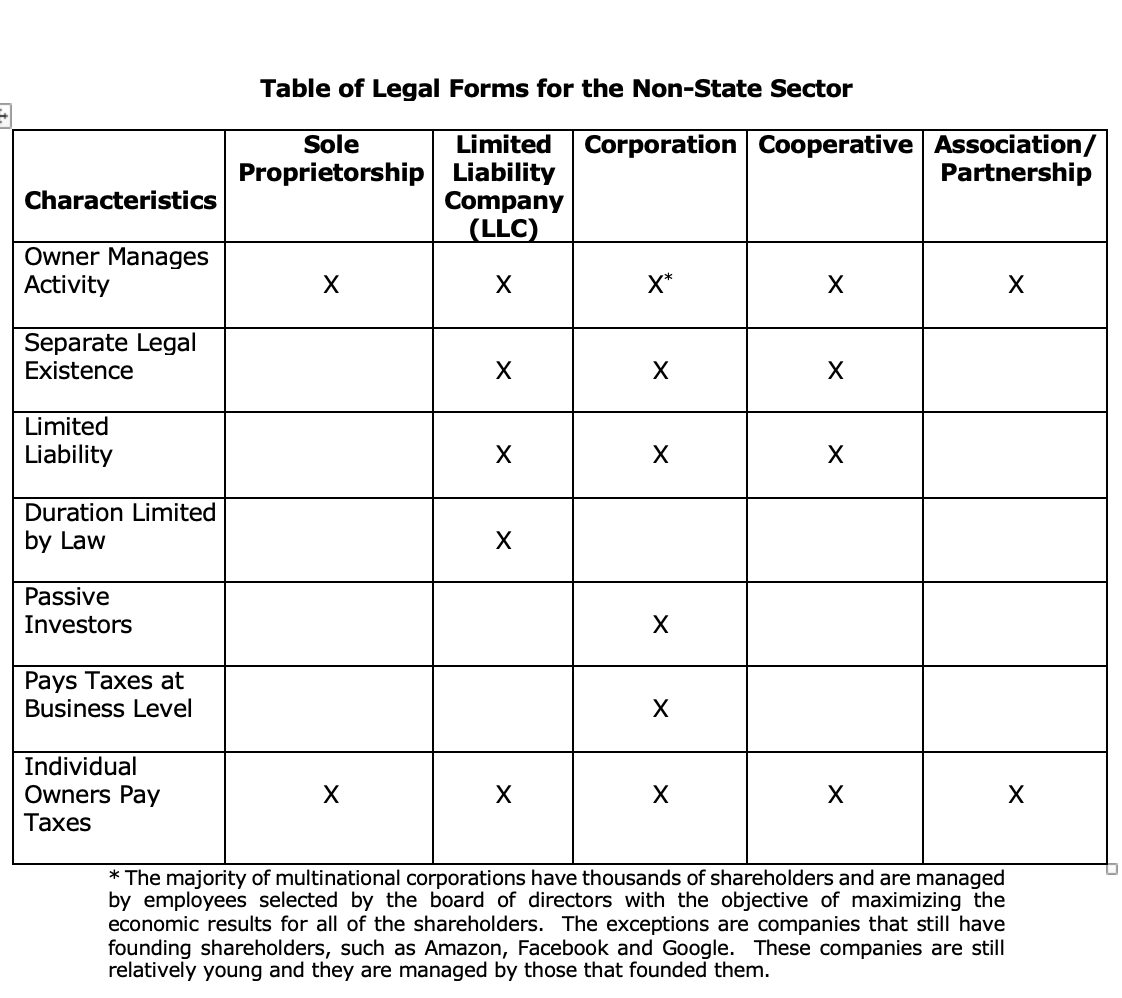

In market economies, the most common forms of business organization are: the sole proprietorship, the limited liability company, the corporation, the cooperative, and the partnership of individuals or companies.

Each one meets particular needs, depending on the type of economic activity and the size of the business. A brief description of how each of these forms operates in a market economy is outlined below.

By Natalia Delgado and Saira Pons Pérez

Introduction

In market economies, the most common forms of business organization are: the sole proprietorship, the limited liability company, the corporation, the cooperative and the partnership of individuals or companies. Each one meets particular needs, depending on the type of economic activity and the size of the business.[1] A brief description of how each of these forms operates in a market economy is outlined below.

The Sole Proprietor or Self-employed Worker

Sole proprietor or self-employed worker (referred to as "cuentapropista" in Cuba) is an individual owner that:

- Manages his own business and is solely responsible for its success or failure;

- Decides when and how to do the work;

- Hires other people with his own funds to help him develop the business; and

- Provides his employees with the necessary equipment to carry out the work.

The property right in a business has two elements: the right of possession and the right of administration.

As the owner of the business, the sole proprietor (and not his employees) is responsible for its losses and debts, including bank credits, tax obligations on the business income, payments to suppliers, obligations imposed by law regarding his employees (wages and benefits) or others (damages that he may cause to others in the operation of the business).

The sole proprietor does not have an entity with separate legal existence. As a result, she cannot limit her exposure to the value of the business and its assets. Instead, she places at risk all of her personal goods, regardless of whether they are related to the business, such as her home, her automobile and her personal savings.

In order to pay taxes, the sole proprietor is generally allowed (in Cuba) to calculate the net profits of his business, that is his gross revenues less demonstrable expenses of the business, as reflected on receipts. These net profits are then added to other income, such as wages – for example, in the case of someone who is a salaried employee by day and operates a business by night – the sale or rent of a good not associated with the business, remittances and social security payments. The sum of all of these sources of income will then be taxed as personal income.[2]

The Limited Liability Company

The limited liability company (L.L.C.) is a creature of law of recent decades developed to give entrepreneurs the ability to limit their legal liability to the value and assets of their business [3].

The L.L.C. it is the form commonly used in many countries for organizing small or medium-scale economic activity, including the kinds of personal, gastronomic, lodging and transportation services that Cuban sole proprietors operate today. It has the following characteristics:

- Legal existence as a separate entity from its owners and employees;

- The right to possession is reflected in interests (shares) that are issued to its members that allow possession to be divided among a modest number of people and entities;

- Responsibility is limited to the assets of the business, not the assets of its members and employees;

- Its duration is limited by law, generally to a period of no more than six decades;

- The ownership interests of member owners in general can be bought and sold only among people who participate in the business; and

- The State does not tax the entity but instead taxes its member owners.

The fundamental difference between the L.L.C. and the sole proprietor is that it does have an independent legal existence from its owner, which limits the owner’s legal exposure to the value of the business. However, in the case of taxes, the L.L.C. is taxed as the sole proprietor is taxed today (in Cuba): it does not pay taxes on the net profits of the business, instead these are considered part of the personal income of the member owners. This is explained in more detail below.

Historically, in most countries, the government has shared in the gains of the economic activity of the non-state sector by charging taxes on all non-state businesses with a separate legal existence from its owners. In addition, it has also charged all individuals on all sources of personal income, including those that those individuals receive in the form of distributions from any business organized as a separate legal entity[4].

As a result, before the L.L.C. was created, if the owners of a business wanted to limit their legal liability, they had to organize as a corporation and pay a "double tax". In effect, the corporation first paid taxes on its net profits and then the owner had to add any after-tax distributions it received from the corporation to other sources of personal income and pay a second tax: that on her personal income.

During the last five decades the use of L.L.C. has emerged with the objective of exempting the small and medium-sized enterprise from the payment of the "double tax" as the capital of these business entities is generally not provided by many passive investors and the owners usually control the firm’s activity. The L.L.C. is an entity that the State considers to have separate legal existence from its owners and limited liability regarding its debts, but with regard to taxes it is treated as a sole proprietorship, with only its members subject to tax. The L.L.C. is designed to allow the sole proprietorship to operate her business with limited liability.

The Corporation (also known as a limited company)

The corporation (sociedad anónima or S.A.) is the predominant form used to organize activity of a larger scale in need of periodic infusions of funds. The corporation is designed to take contributions of savings (capital) from many individuals who will not participate in the business and are willing to take the risk that others will manage it profitably.

The characteristics of the corporation make it suitable for large economic projects. They are the following:

- The concept that it has a legal existence as a separate entity from its owners and employees[5];

- The right to possession is reflected in securities that it issues and that allow the division of possession among a large number of people and entities[6];

- Legal liability is limited to the assets of the entity, not its shareholders, directors and employees;

- Its duration is not limited by law[7];

- Its shares can be bought and sold in a way that allows the passive investment of savings by those who do not participate in the business; and

- There is a separation between possession and control [8] so that the shareholders only choose the board of directors, but they do not control the operations of the company.

During the last century, the corporation has been the predominant form used when organizing a business in order to obtain a larger scale, attract capital and expand economic activities. Almost without exception, multinational companies are organized as corporations.

In the case of corporations, the State will impose taxes on the profits of the business activity in addition to the personal income taxes that each of the shareholders must pay. In general, the law imposes a lower rate on the returns of passive capital investments as an incentive for individuals to take the risk of investing their savings in an economic activity that they do not control.

Usually, when transnationals invest in a country and do not expect to generate net profits during the early years, they use an L.L.C to make the investment. In this way they can deduct the losses of the new investment from the revenues of the parent entity. When it expects to generate net profits, the parent company can convert the L.L.C. in a corporation organized in the country where it invests.

The above is particularly important for the multinational corporation that wants to make secondary investments in a particular country. When converting a L.L.C. into a corporation, it is not in effect repatriating the net profits and paying taxes on those in the country of the parent company. Instead, it leaves the profits in the country where the investment was made and thus accumulates capital there for the subsequent investments in that country, paying only the local tax.

Forming an L.L.C. and a Corporation. The laws that define what is a L.L.C. or a corporation are virtually the same all over the world. These entities are usually easily organized in a matter of days or a few weeks. The law allows people interested in forming a company to select from a menu of options. The process of formation is fast: the organizer selects from the menu and the certificate of incorporation (in the case of the corporation) or of organization (in the case of the L.L.C.) only includes the options selected when the organizer has the right to select between two or more options. (The person reviewing the document needs only to confirm that the organizer selected correctly from the menu and this can be done quickly.) The certificate is relatively short because the rest of the provisions are already provided by law. The certificate in final form is filed in the commercial register and is public.

The Cooperative

Another way to organize activities in a market economy is the cooperative, which can take varying legal forms[9]. Cooperatives fulfill several key functions.

Perhaps the best known is the cooperative whose workers own and produce a good, such as in agriculture. This category also includes agricultural producers who harvest on their private property, but share certain assets - for example, olive growers who share the olive oil production facility. They also include groups of individual owners of hardware stores who purchase wholesale as a consortium and then resell those goods at retail in their hardware stores.

In other cooperatives, the owners are the consumers of a good that they produce or manage for their members. This group includes utility companies - electricity and water, for example – who provide those goods to people living in a certain area. Perhaps the most common form of this type of cooperative is the apartment building. The owners have their individual apartments, but they share common spaces, manage the maintenance and the rules for coexistence.

A third group are cooperatives that provide services only to their owners / members. These include credit organizations - typically associated with an institution such as a university or government entity - or insurance companies that offer insurance policies only to their members. At the end of the year, they distribute among their members the profits they do not need to retain for operations.

The cooperative, like the L.L.C., is ignored by the State when imposing taxes. As is the case in Cuba, members of the cooperative only pay taxes on the distributions. But the tax rate is the same as that of every other individual because individual income taxes are assessed on his personal income regardless of the type of economic activity that generates the taxable income.

The Association (Partnership)

In a market economy, when more than one person engages in an economic activity and is directly involved in its operation, the law considers it an “association” or “partnership”. The partnership has no independent legal existence or limited liability. It is the most popular form of organization for lawyers, accountants, consultants and other professionals. As professionals cannot limit their legal responsibility in the exercise of their profession, the partnership is a flexible way to organize: it allows easy addition and departure of members. Each change of membership composition creates a new partnership, so that associations are constantly reconstituted. The law of partnerships focuses, above all, on regulating economic relations between the partners.

In the association each partner contributes with capital to finance the activities and also contributes with her work. The profits are distributed among the partners according to the arrangement they reach: how much they work, their level of expertise, and the revenue generated by the partnership from clients that the partner attracts. The State does not tax the net profits of the association, but the individual partners pay taxes on all the distributions the association makes to them.

The partnership is also one of the forms that a joint project between two companies can take. It is also used for real estate projects when there is more than one partner and the project is not expected to last for many years.

[1] The nonprofit corporation also plays an important role in organizing economic activity. Examples: hospitals, universities and the Red Cross. In contrast to the other forms of organizations described here, the nonprofit corporation cannot distribute its profits but must retain them to further its purposes.

[2] In Cuba, the current tax law (Law 113 of 2012) provides that personal income tax is applied on the total income of each person. However, in practice this is not the case. Currently, taxes are collected only on five types of personal income: 1) revenues from self-employed activity, 2) profits distributed by cooperatives, 3) salaries received from foreign companies and institutions, 4) earnings of artists and athletes, and 5) any additional income over and above the basic salary paid by state enterprises. Therefore, the sworn statement presented by Cuban “cuentapropistas” only includes income from their business and that is not combined with other remunerations, such as from a government salary, remittances from abroad, interest income, or social security payments.

[3] The limitation of liability does not excuse tax obligations to the State or wages due to employees.

[4] In most market economies, the tax that the individual owes the State is based on the amount of his personal income according to a progressive scale – the higher the income, the greater the percentage of his earnings are due in taxes to the State. It does not matter what economic activity produces the individual's income.

[5] For the multinational company, this feature of a separate legal existence allows it compartmentalize its operations in each country where it operates.

[6] The corporation is not limited in the number of shareholders it can have. It may also issues its shares in exchange for other assets, such as intellectual property and work not compensated in cash. Many corporations issue shares to their workers as part of their compensation.

[7] Except in case of bankruptcy or merger with another entity or by vote of its shareholders.

[8] One or more of the shareholders may also be employees or directors.

[9] The chosen form of organization could be a law specifically for agricultural cooperatives, a corporation that issues shares only to members of the cooperative, or a L.L.C. The main difference is that profits are divided among the group that forms it, whether they are agricultural producers, a group of consumers, or owners / members. Generally it does not have passive investors.

Saira Pons Pérez is an economist and public policy analyst with more than 10 years of experience as an academic researcher for the Center for the Study of the Cuban Economy (CEEC) of the University of Havana and the Ministry of Economy and Planning. She received her bachelor's degree, "cum laude", in economics from the University of Havana and her master's degree in public policy from King's College, London, United Kingdom. She has presented in various Cuban universities and at others of international prestige, such as Harvard University, City University of New York (CUNY) and the University of Santiago de Chile. https://www.linkedin.com/in/saira-pons-2b70623a/