Cuba's Outflow of Capital

Understanding capital movements is important for Cuba to design policies that attract investment capital from domestic and foreign sources.

Is capital flowing out of Cuba? This is perplexing, as it is evident that Cuba needs inflows of investments and capital. I try to answer this question by looking at available information from international sources as Cuba does not disclose data about the movement of capital in and out of the country. Understanding capital movements is important to designing policies fostering capital formation from domestic and foreign sources.

Capital Outflow and Capital Flight

Developing countries expect to get capital from foreign sources, as returns on capital tend to be higher from investments made in developing countries than those made in wealthier lands. Actual experience indicates, however, that capital does not always flow from richer to poorer countries. Flows are conditioned by many factors. For example, returns to capital in relation to risk may often be lower in less developed countries due to local restrictions on capital movements, political instability, poor local business conditions, uncertain governmental policy, among other factors.

In conditions of financial and political instability many countries experience what is known as “capital flight”. This is an informal name for the rapid accumulation of foreign assets by individuals and firms in the developing country due to domestic instability. It is most often accompanied by pressure on the exchange rate and an increase in the use by domestic persons of foreign financial assets, as well as investments in real estate and other physical assets. While there are elements of “capital flight” in Cuba, the shallow depth of its financial system narrows the opportunities for capital flight. In my analysis, I look instead at the broader concept of “capital outflow”. Capital outflow comprises return of capital, repayment of loans and the conversion of domestic assets into foreign assets. It is a broader concept than capital flight.

Cuban Deposits and Reserves in International Banks

International reserves, liquid assets in hard currency at the disposal of a country’s central bank are key indicators of a country’s international capital flows. A loss in international reserves signals capital outflow while an increase in reserves reflects an inflow of capital. The Central Bank of Cuba (the “Central Bank”), unlike other central banks, does not publish its international reserve position. Therefore, I turn to international banking data to obtain solid information about Cuba’s deposits in hard currency. The Bank for International Settlements (“BIS”) reports on deposits and loans in the international banks of 48 countries, comprising all developed economies, major developing countries and offshore financial centers. BIS data provides an estimate of Cuba’s operational reserves. These are reserves used in the management of international liquidity by the Central Bank.

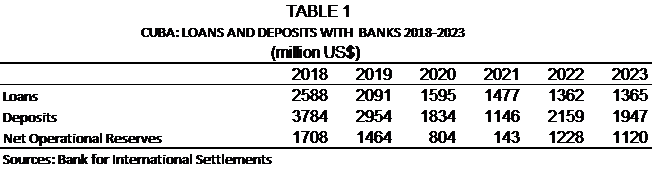

Table 1 shows loans to and deposits of Cuban entities with international banks as reported by the BIS. It provides interesting information regarding capital movements. Outstanding bank loans to Cuba of $2.6 billion in 2018 dropped by one-half by 2023 This means that there has been a repayment of loans to banks in the last six years. In the same period, Cuban deposits in international banks dropped by one-half from $3.8 billion to $1.9 billion, indicating a loss of liquidity.

Net operational reserves are estimated from the BIS data and are shown at the bottom of the table. It is equivalent to the hard currency deposits of Cuban banks less loans to those banks, excluding transactions with non-financial firms (those not engaged in financial services). Net operational reserves are an estimate of the hard currency assets available to the Central Bank. At the end of 2023 net operational reserves were $1.1 billion, equivalent to just 1.3 months of merchandise imports, a very low level. Net reserves have been at a low level in the past six years and fell to near zero in 2021 during the pandemic. Reserves recovered in 2022-2023 to a very low level. The loss of reserves in 2018-2023 is evidence of capital outflow.

In the last five years the government drew down assets to help pay for imports, repay loans, and return capital to foreign investors in Cuba, while providing some funding for CADECA exchange houses (the government operated foreign exchange houses).

Naturally, this table provides an incomplete picture. First, the BIS data does not cover Cuban assets held outside of BIS banks, such as in Chinese financial institutions and developing countries that do not report to the BIS. Second, the BIS data does not reflect capital flows in informal transactions.

Foreign Investment

The business environment in Cuba is far from ideal for foreign investment despite government efforts to ease some investment procedures and give investors more management leeway. It is a high risk financial and regulatory environment that generally attracts investors demanding high returns on capital. Cuba also lacks the support of international agencies and wealthy countries that could cover some of the risk of investment in Cuba and incentivize the government in Cuba to carry out meaningful reforms.

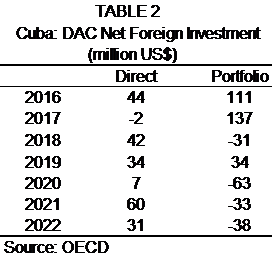

Cuba does not publish data on foreign investment flows. Officials occasionally mention investment projects in Mariel and other locations but these are long-term commitments not significant cash investments (Reuters 2020, EFE 2022). Cuba is one of a handful of countries not covered in the World Bank’s foreign investment database (World Bank 2024). The Organization for Economic Co-operation and Development (“OECD”), a group of rich countries, publishes data on direct (long-term) and portfolio (short-term) investment from the 24 countries that are members of its Development Assistance Committee (OECD 2024). This includes investment from the 20 largest economies in the OECD.

There was negligible net direct investment in Cuba in 2016-2022 from the OECD, which as described above, includes the countries with the largest and most dynamic market economies (Table 2). OECD's recorded investments are estimated to be about one-third of all direct investment in Cuba. Offshore financial centers are used to book foreign investments by corporations in OECD countries which are not therefore recorded as arising from the OECD. Data from neighboring countries of Cuba indicate that OECD registered investments are about one-third of total direct investments in those countries. Adjusted flows comparable to World Bank data place net direct investment at about $100 million in 2022 or some 0.1% of Cuba’s GDP, well below the government’s target of 2%. Data on net portfolio investment from OECD countries shows outflows in four of the five years ending in 2022. Portfolio investments in Cuba consist of certificates of deposit and similar instruments. There are no marketable securities such as stocks and bonds issued by Cuban entities. A net outflow means that foreigners are taking assets out of Cuba in excess of capital flows coming into the country.

Black Peso Market and Remittances

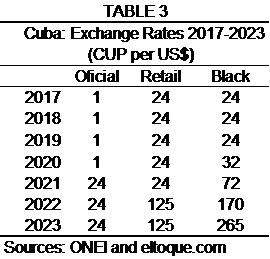

Cuba has three exchange rates: an official rate for state entities, a retail rate for individuals through CADECA exchange houses, and a black or informal market rate. Only the black market rate of the peso against a foreign currency is set by demand and supply through open market transactions. The black market is a residual market, since the bulk of foreign exchange transactions are at the controlled official rate used by state companies and government entities. CADECA operations are limited by the restricted supply of foreign exchange provided by the government and by the unappealing prospect of selling dollars and euros at rates well below the black market rate.

As can be seen on Table 3 below, there was a 112% differential between the retail and black peso rates at the end of 2023 and over a 10 times multiple between the official and black peso rates.

The peso depreciated in the black market from 32 per dollar in 2020 to 265 at the end of 2023 and nearly 400 in mid-May 2024. This shows that demand is far outpacing supply of dollars in the black market.

Demand for dollars in turn is driven by differing forces: import of goods and travel needs of individuals and small private firms, the use of the dollar as a medium of exchange, and the use of the dollar use as a store of value (Calvo 1992).

The first element is derived from the on-going need of individuals and small firms known as MIPYMES (small and medium private enterprises) to satisfy consumption and operating expenses. The other two elements involve currency substitution from pesos to dollars exacerbated by a woefully inadequate monetary policy (Vidal 2022). In other words, the population uses the dollar to hold savings and to pay for purchases instead of pesos.

Generally, currency values are driven by monetary conditions, and this is largely the case as well for the Cuban peso. High inflation resulting from ultra-lax monetary policy fuels dollar demand. There are additional factors driving currency substitution in Cuba, such as the recent and incomprehensible move by the authorities to soak up peso currency in circulation, adding fuel to the fire by further undermining the peso as a means of payment and standard of value.

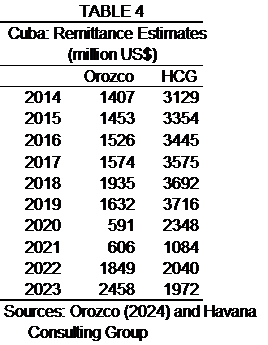

What about dollar supply in the black peso market? Remittances are the main source of dollars in the black market. Tourist outlays to individuals and foreign currency savings held by the population are additional sources. There are no official statistics on remittances. Table 4 presents estimates by Orozco (2024) and the Havana Consulting Group (HCG) (2024) of remittances to Cuba in 2014-2023. These two estimates coincide in registering a marked fall in remittances during the pandemic but diverge in the level of pre-pandemic flows and in the pattern of recovery during the period of 2021-2023. Orozco and HCG place 2023 remittances in a range of $2 to $2.5 billion. Orozco’s estimates place remittances in 2023 above pre-pandemic levels while HCG’s numbers denote a considerable fall.

Remittances are free transfers from abroad to local residents – not payment for goods or services. Therefore, remittances are not considered in calculating capital flows. However, remittances play a major role in the operation of the informal peso market. Remittances are used to obtain dollars and euros in exchange for pesos in the foreign exchange market, some of which can be considered part of a capital outflow if held by Cuban residents in bank accounts abroad.

What is the extent of this outflow? One can think of the estimates in Table 4 as an upper limit to the capital outflow, as remittances are the dominant source of foreign exchange in the black market. In practice, a large portion of remittances are used by the recipients for consumption of domestic or imported goods and services directly or through the currency black market. Working through the black market, remittances are an important element of capital outflow, as they enable island residents to accumulate foreign assets and support emigration and travel abroad.

Conclusions

All the data from international statistics paint a picture of capital outflow in Cuba, a troubling sign for a developing economy. There is a loss of reserves by the Central Bank, negligible net direct investment and a net outflow of portfolio investment. Informal transactions are difficult to gauge. Capital outflow takes place in the black peso market. Remittances provide dollar liquidity to the peso market and allow the transfer of assets abroad by residents. Capital loss in Cuba is evidence of deeply flawed monetary and development policies.

References

Bank for International Settlements, 2024, bis.org/locationalstatistics

Calvo, G. and Vegh, C, 1992, “Currency Substitution in Developing Countries: An Introduction.” IMF Working Papers, May.

EFE, 2022, “Monto de Inversiones Comprometidos de mas de $3,000 millones.” swissinfo.ch, July 10.

Havana Consulting Group, 2024, Table published in revistaestornudo/remesas, February 19.

Luis, L, 2023, “Determinants of Recent Foreign Investment in Cuba.” ascecubablog, May 11.

OECD, 2024, Geographical Distribution of Financial Flows to Developing Countries.” oecd-library.org

Orozco, M., 2024, “Remittances to Cuba and the Marketplace in 2024.” Inter-American Dialogue.

Reuters, 2020, “Cuba attracts $1.9 billion in foreign investment despite U.S. sanctions,” December 8.

Vidal, P., 2022, “Ten Point Program to Stabilize Cuban Economy.” Cuba Capacity Building Project, horizontecubano.law.columnia.edu, November 15.

World Bank, 2024, databank.worldbank.org.

Luis R. Luis is an international economist in Massachusetts specializing in international finance and investments. He is cofounder of International Research and Strategy, a firm centered on emerging markets finance. Previously he was Managing Director at Scudder Investments in Boston directing international research and helping to manage international fixed income and equity portfolios. He was Director, Latin America Department, at the Institute of International Finance in Washington. Luis also served as head of international economics at Midland Bank in London and Crocker Bank in San Francisco and was Chief Economist at the OAS in Washington. He was in the economics faculty at the US Naval Academy in Annapolis and American University and held a Fulbright visiting professorship at University of Trujillo in Peru. He has lectured on international economics at universities in several South American and European countries. An author of articles on international finance and on the Cuban economy and a contributor to several books on emerging markets and portfolio management, Luis holds a PhD degree in economics from the University of Notre Dame.